Georgetown County

Five-year pay plan proposed to reduce staff turnover

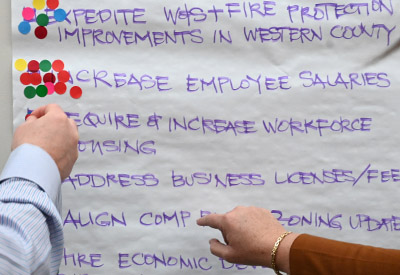

A five-year plan will raise pay for Georgetown County employees 16 percentage points over the first three years in an effort to catch up with inflation and reduce turnover. But it still won’t make the county’s pay scale competitive with its larger neighbors, officials say.

The plan presented to County Council this week will start with a 2 percent increase in May, two months before the start of the new fiscal year.

“This is not to meet market demand. This is just to keep up with inflation,” said Walt Ackerman, the county director of Administrative Services.

The county has 655 authorized positions. About 60 are currently vacant, Ackerman said.

The turnover rate went from just over 10 percent a year before the pandemic to over 22 percent in 2023, with the highest numbers for the jail (70 percent) and 911 dispatchers (26 percent).

Turnover is now around 17 percent.

The county began raising pay for public safety workers in 2022 and for other employees the next year. But Ackerman said it will help retain employees if they know that raises will continue.

Employees with less than five years of experience currently account for 53 percent of the county’s workforce. “They’re not fully settled into the county. They can leave at any time,” Ackerman said.

And exit interviews show the biggest reason for leaving is pay.

All but the top 9 percent of county workers earn less than $70,000 a year, Ackerman said. A $70,000 income would qualify for a mortgage on a $200,000 house, but the average home in Georgetown County sells for more than $300,000, he said.

The pay plan calls for a 5 percent increase when the new fiscal year begins in July. Another 2 percent raise will follow in January. Pay will go up 5 percent in July 2026 and 2 percent in January 2027.

For the remaining years, Ackerman said the plan is based on 3 percent annual increases.

The money will come from surpluses that the county has accumulated and won’t require a tax increase. At the end of the five years, the surplus would still be just over $13 million.

The county plans to put a local option sales tax on the ballot in November 2026. If successful, 71 percent of the revenue would be used for a property tax credit, but the balance can be used for local government operations by the county and its municipalities.

A similar tax failed by a handful of votes last year.

The county will also upgrade software next year for collecting its local accommodations and hospitality taxes. That will facilitate collection of a business license fee that the council has considered for several years.

Ackerman said the fee could raise $8 million a year, “give or take $5 million.” He added that the city of Georgetown raised $3 million from the fee when he worked there.

“That would be a breath of fresh air,” Council Member Bob Anderson said.

He asked about doing performance reviews along with raises.

The county does those, Ackerman said, but those won’t get employees to “the minimum level where they need to be.”

Council Member Raymond Newton was concerned about committing to a five-year plan. “It’s a lot harder to take it back after you promise it,” he said.

It can always be changed, Ackerman said.