Georgetown County

Growing surplus seen as sign of financial strength

Georgetown County continues to save money for a rainy day, like the ones that come with hurricanes.

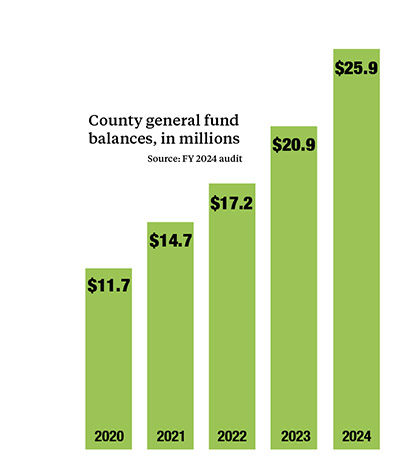

The surplus in the county’s general fund increased by $5 million last year, according to an annual audit, and at $25.9 million represents enough money to run the county for almost eight months.

“That percentage is an indication of financial strength,” said Alan Thomspon, principal in the firm that performed the audit.

He was asked by County Council members this week whether the increase in the surplus and in overall spending was normal.

“It’s a very conservative position,” Council Member Bob Anderson said.

The general fund surplus, or fund balance, has increased in each of the last five years. It was $11.7 million in fiscal year 2020, which included the start of the coronavirus pandemic.

“Normal is hard to define,” Thompson said.

Last year, County Council changed its budget policy to require a minimum fund balance of $15 million in the general fund. It had been 35 percent of its annual expenses, but no less than $8 million. The current amount is 65.5 percent of expenses.

The goal was to have enough money on hand to deal with a major natural disaster or other emergency.

The fund balance growth for fiscal 2024 came from revenue that was above budget, including an additional $1.5 million in property taxes, and expenses that were below, including $1.2 million due to staff vacancies.

Property taxes account for 60 percent of the county’s revenue and that increased 30 percent over the last five years, according to the audit.

“The growth, and a lot of it might be coming from development, is causing taxes to increase at a significant rate. That’s going to result in the county over a long period of time having to provide additional services for those folks,” Thompson said.

Council Member Raymond Newton asked if that was normal. “We’ve never experienced anything like that,” he said.

Of the 150 local government’s Thompson’s firm audits, he estimated that 90 percent have seen revenue increases. Georgetown County’s increase is about the same as Brunswick County’s in North Carolina.

“A lot of people are loving the coast,” he said.

Along with increasing the surplus, the county also increased its debt last year, more than doubling its outstanding obligations to $119.5 million from the previous year. That was due to a $61.6 million bond issue to fund construction of a new county jail.

County Council raised its tax rate for debt service over the last two years in anticipation of the jail bond.

Council Member Stella Mercado asked Thompson how much of a surplus is needed to ensure the county gets a favorable interest rate on bonds.

He said that’s typically 40 percent, “so you’re in good shape.”

But Thompson also noted that lenders look at the underlaying tax base and the percentage of taxes that are collected. The county collection rate dropped from 98 percent in 2020. It bottomed out at 95 percent in 2023. Over that period each percentage point was equal to between $450,000 and $550,000.

He told the council that he was comfortable with the surplus and revenue growth in Georgetown County.

At the growth rate you’re having, I would say I’d be nervous about curbing it a whole lot below that for the time being,” Thompson said.