Georgetown County

Reassessment math: As property values soar, tax rate will fall

Even people who have not bought or sold property in the last five years have a pretty good idea how real estate prices have increased on the Waccamaw Neck. This year, that will be confirmed when Georgetown County completes the property reassessment process required by state law.

The county is preparing for what one official said isn’t just sticker shock, but “sticker stroke.”

“All of this stuff seems a little scary for the taxpayer,” Walt Ackerman, the county director of Administrative Services, told County Council members during their annual planning retreat last week.

In past reassessments, some property rose in value. Some stayed the same or declined. This time will be different due to the spike in sales that came with the coronavirus pandemic in 2020.

“I don’t think we’re going to see properties going down unless they’re in disrepair,” Ackerman said.

But the rise in property values does not mean that there will be a corresponding rise in property taxes.

State law prevents local government from reaping a property tax windfall from reassessment. In fact, the actual value of many properties won’t be reflected on the tax bills because state law also caps the amount that the taxable value can rise at 3 percent a year – unless that property is sold.

“All we’re doing is changing the value on the books. We’re not trying to get more tax revenue,” Ackerman said. “That’s not allowed by law.”

Rising prices

Every time a piece of property is sold, the county collects a “recording fee,” based on its value.

In the fiscal year that ended June 30, 2019, the amount of those fees was $169,498.

In the 2021 fiscal year, at the height of the pandemic, those fees increased 90 percent, totaling $321,267.

“We never dreamed what homes were selling for,” Ackerman said.

Under the reassessment process, sales in the fourth year of the five-year cycle are used to reset the values. So 2019’s pre-pandemic sales set the values for the 2020 reassessment. Sales in 2024 were used for the current reassessment.

While the prices have eased, “they’re still astronomically higher than they were in 2019,” Ackerman said.

The county is required to send reassessment notices to the owners of each parcel that changes in value by at least $1,000. Those are expected to go out in July.

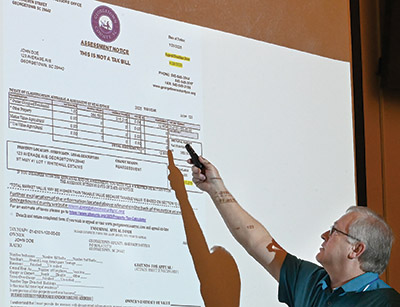

“Most people see this and have a heart attack,” said Tim Holt, the county’s assessor.

That’s because they think it is their tax notice.

“It says ‘this is not a tax bill.’ Most people don’t look at that,” he said.

What the notice will show is the market value of the property and the taxable value. If the property didn’t sell in 2024, the market value is likely to be higher than the taxable value because of the state law that caps annual increases at 3 percent.

For people who own the same property now that they owned in 2019, the taxable value won’t increase more than 15 percent no matter how much the market value has increased.

The county plans to print the taxable value in color on the assessment notices to draw attention to that point, Ackerman said.

The notices will also include the “tax ratio.” Owner-occupied homes are assessed at 4 percent of their taxable value. Commercial property and second homes are assessed at 6 percent.

The tax bill

A $100,000 home with a 4 percent tax ratio would pay property taxes based on $4,000. That number will show up on the notices as the “total assessment.”

That isn’t the tax bill, which will be sent out in the fall. At the current tax rate, the bill for that home would be $326.40 for the county, not including fire protection.

Under reassessment, that bill would not change much unless County Council votes to increase the tax rate.

For example, if that $100,000 home now has a market value of $175,000, the state cap would limit its taxable value to $115,000, a 15 percent increase over the five-year reassessment period.

State law requires the county to roll back the tax rate so that its property tax collections in the reassessment year are no higher than the collections in the previous year.

“We cannot get a windfall from reassessment,” Ackerman said. “We can’t get any more taxes than we did the year before.”

The rollback is based on the total value of property in the county. It is not calculated for each parcel separately.

If a piece of property does not increase in value, the rollback will result in a tax reduction for the owner. Because of the rise in prices since the pandemic, “there are going to be very few people that benefit,” Ackerman said.

He estimated that the tax rate will be rolled back 12 to 13 percent. That means an owner whose taxable value increased by the maximum of 15 percent could see a 2 to 3 percent increase in property taxes.

For the hypothetical $100,000 owner-occupied home that 12 percent rollback looks like this: It will now have a taxable value of $115,000, an assessed value of $4,600 and a tax bill of $330.28. That’s $3.88 higher than last year’s bill.

How to appeal

The assessment notice includes a form that allows property owners to appeal the county’s valuations. Those values are based on sales of comparable property in the area along with the age and condition of the property.

The assessor’s office uses site visits, drone imagery and software programs to value property. With 57,000 parcels and five assessors, “we can’t go to each one,” Holt said.

Owners who think the assessors have made a mistake, have 90 days to file an appeal.

“You do not need to hire an appraiser,” Holt said.

Staff will review the assessment with the owners to explain how they reached their valuations. “If it’s got an error in it, we need to know,” he said.

Correcting errors isn’t limited to reassessment years. “I’ll do that all year long,” Holt added.

If an owner still disagrees with the staff decision, it can be appealed to the county Board of Assessment Appeals. The last time that board met was in 2018, Holt said. The Founders Group wanted the county to reduce the value of five of its six golf courses. The staff had offered a 15 percent reduction. Founders wanted 25 percent.

The appeal was denied and, after consulting with an attorney, Founders decided not to appeal to the state, Holt said.

The terms of four appeals board members have expired. Two others have terms that expire next month. One seat is vacant.

Ackerman asked the council members during their retreat to come up with seven new board members so they can be seated in March and get training in the appeals process from the state Department of Revenue before the assessment notices go out.

“Hopefully, the appeals board never convenes,” Ackerman said.